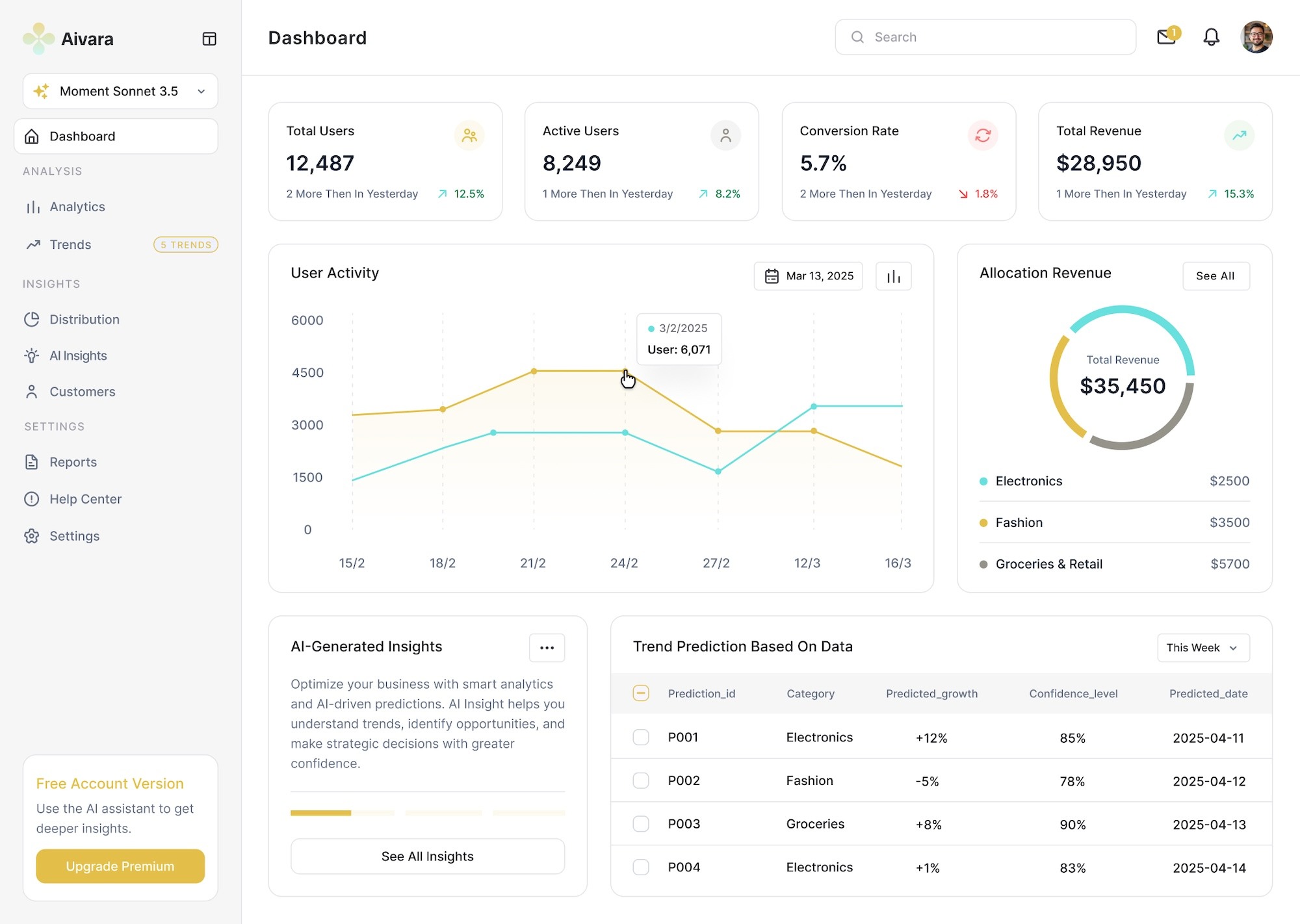

BharatAPI is a secure and scalable API platform designed to help businesses automate identity verification, document authentication, and compliance workflows. Our suite of APIs empowers enterprises, fintech platforms, and service providers to perform accurate verification instantly — improving onboarding, reducing risk, and enhancing trust.

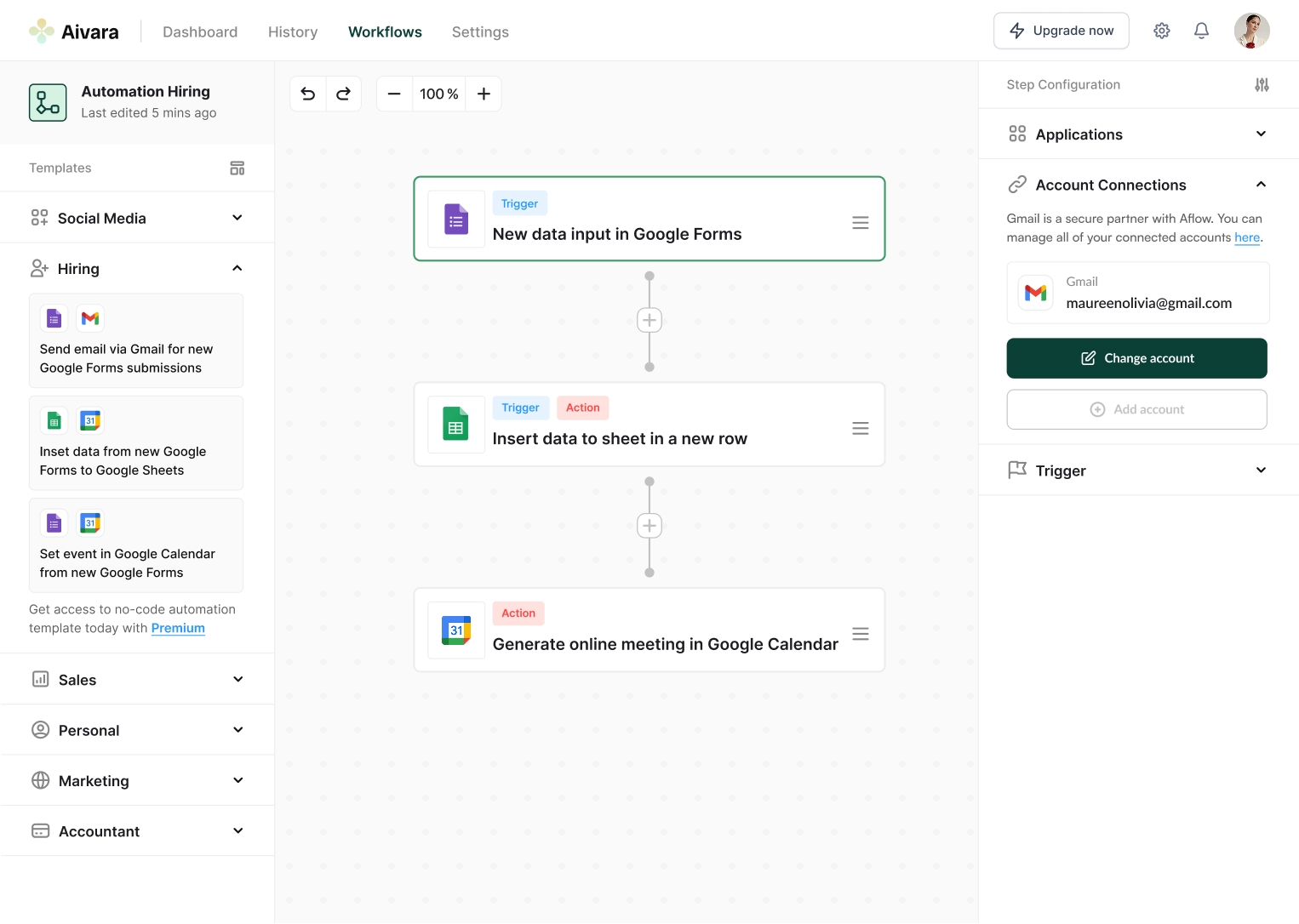

To simplify complex verification processes with easy-to-integrate APIs, enabling developers and businesses to build powerful verification workflows without heavy infrastructure or compliance headaches.

BharatAPI delivers compliant verification solutions that accelerate digital onboarding, reduce fraud, and ensure regulatory confidence across high-trust industries.

Built to support regulatory KYC and verification standards across fintech, lending, HR, and telecom industries.

Simple REST APIs with clear documentation enable fast, seamless integration into apps, platforms, and systems.

Instant identity and document verification ensures faster customer onboarding and reduced operational friction.

Instant identity and document verification ensures faster customer onboarding and reduced operational friction.

Enterprise-grade security and scalable infrastructure built to handle high-volume verification workloads reliably.

Simple REST APIs with clear documentation enable fast, seamless integration into apps, platforms, and systems.

Fintech companies, NBFCs, lenders, aggregators, HR agencies, and digital businesses that require fast, compliant, and secure verification systems.

BharatAPI enables instant identity verification through Aadhaar, PAN, and other government-backed sources to support compliant onboarding.

Vehicle Verification APIs enable businesses to validate RC details, challans, ownership data, and driving licenses for onboarding, compliance, and security checks.

From GST info to RC checks, BharatAPI simplifies compliance verification using reliable, authoritative data sources.

BharatAPI enables employment, business, and background verification checks that support compliant onboarding and reduce risk for HR teams and enterprise platforms.

Project Manager

Technical Head

Cloud Architect

Data Analyst

AI Developer

Cloud Architect

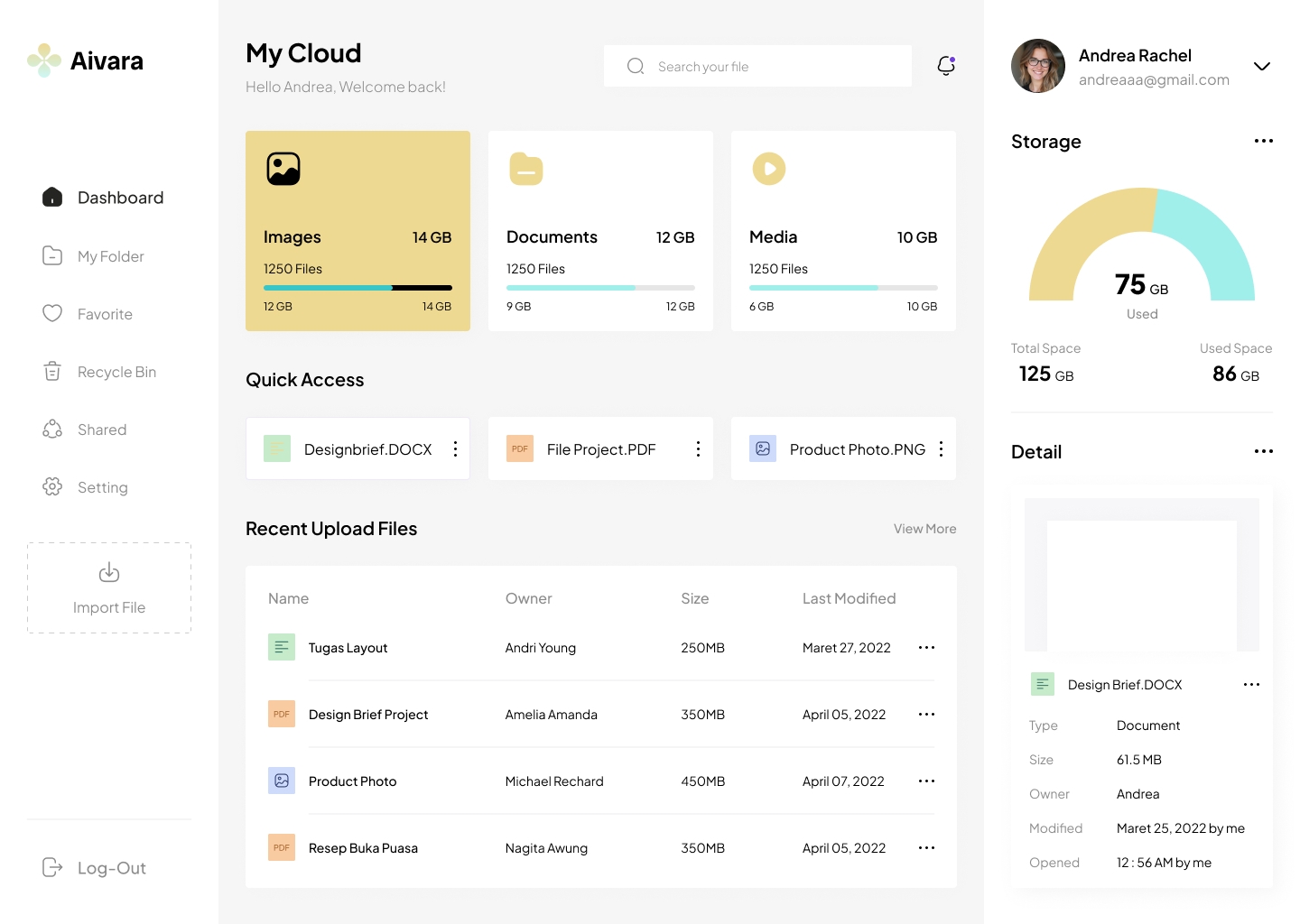

At Aivara, our clients’ success is the measure of our own. Discover how Aivara’s AI services have helped them solve challenges and seize opportunities.

Digital Lending & Wallet Platforms

BharatAPI enables instant KYC, financial validation, and compliance checks, helping fintechs onboard customers faster while reducing fraud and operational overhead.

Hiring & Employee Background

Using BharatAPI’s identity and employment verification APIs, HR teams can authenticate candidates quickly, improving hiring speed and reducing manual document checks.

Most verification APIs process and return results in real time or within a few seconds, ensuring smooth onboarding without delays.

Yes, BharatAPI provides a sandbox environment for developers to test integrations, workflows, and API responses before going live.

Yes, the APIs are REST-based and can be integrated into mobile, web, and backend systems using standard industry protocols.

Yes, integration guides, API documentation, and sample code are available to support developers during onboarding and deployment.

Pricing can be customized based on usage volume, API call frequency, or enterprise requirements including compliance and SLAs.

Yes, identity validation, matching, and document verification features help reduce fraudulent activity and identity duplication.

Minimum usage depends on the plan; enterprise and high-volume users typically have flexible options tailored to operational scale.

Fintech, NBFCs, lending, telecom, eCommerce, insurance, logistics, HR verification, and digital identity platforms are common users.

Data handling policies depend on regulatory requirements and the nature of the verification, with options for minimal storage or session-based processing.

Yes, APIs are designed to support digital KYC and onboarding workflows aligned with compliance and governance expectations.